does florida have an estate tax return

Taxes on the federal return federal Form 706 is the amount of Florida estate tax due. This applies to the estates of any decedents who have.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

See what is deductible if you own a trust in the tax year 2018.

. Even though the removal of the federal credit means Florida residents wont have a Florida estate tax liability the lien still automatically applies to any Florida estate. WASHINGTON Victims of Hurricane Ian that began September 23 in Florida now have until February 15 2023 to file various individual and. Florida does not have personal income estate or inheritance taxes.

Florida is extremely tax-friendly as it boasts no state income tax which means Social Security income pension income and income from an IRA or 401 k all goes untaxed. A federal change eliminated Floridas estate tax after December 31 2004. There are no inheritance taxes or estate taxes under Florida law.

Floridas general state sales tax rate is 6 with the following exceptions. In 1924 they passed an amendment to the Florida constitution. If any of the.

The 25k exemption refers to an exemption. Florida Estate Tax. Florida one of our 10 most tax-friendly states for retirees has no state income tax.

The state of Florida doesnt have an estate tax but that doesnt make you exempt from the Internal Revenue Services federal estate tax. If the following does not apply to you you are not required to file the return. In Florida theres no state-level death tax or inheritance tax but there is still a federal.

Estate income tax returns are only required if estate assets generate more than 600 of income annually. Floridas a Lot Less Taxing. Even though florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

Discover the differences between the types of trusts and the ways the IRS will tax you if you have one. Florida Form F-706 and payment are due at the same time the federal estate tax is due. The federal estate tax.

Why is there no state income tax in Florida. Does Florida Have an Inheritance Tax or Estate Tax. The federal law allowed a federal credit for state death taxes on the federal estate tax return.

Federal Estate Tax. Counties in Florida have the authority to levy an ad valorem tax on tangible personal property. Cannot increase by more than 3 of the previous years assessment or the Consumer Price Index whichever is less.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The types of taxes a deceased taxpayers estate can owe are. Previously federal law allowed a credit for state death taxes on the federal estate tax.

However in December 2004 the. Income tax on income generated by assets of the estate of the deceased. Florida used to be an estate tax-paying state.

If the estate generates more than 600 in annual gross. FL-2022-19 September 29 2022. That means no state taxes on Social Security benefits.

Does Florida Have An Estate Tax

Where To Get Florida Forms Dr 312 And Dr 313 To Show No Estate Tax Liability Tampa Bay Homes For Sale Re Max Acr Elite Group Inc

State Estate And Inheritance Taxes Itep

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

The Florida Homestead Exemption Explained Kin Insurance

Does Florida Have An Inheritance Tax Alper Law

Inheritance Tax What It Is How It S Calculated Who Pays It

Notice Of Federal Estate Tax Return Due P 3 0950 Pdf Fpdf Doc Docx

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Tax Rules On Estate Inheritance Taxes

Estate Tax Definition Federal Estate Tax Taxedu

Dr 312 2002 Form Fill Out Sign Online Dochub

Florida Real Estate Taxes What You Need To Know

Does Florida Have An Inheritance Tax Alper Law

Considerations For Filing Composite Tax Returns

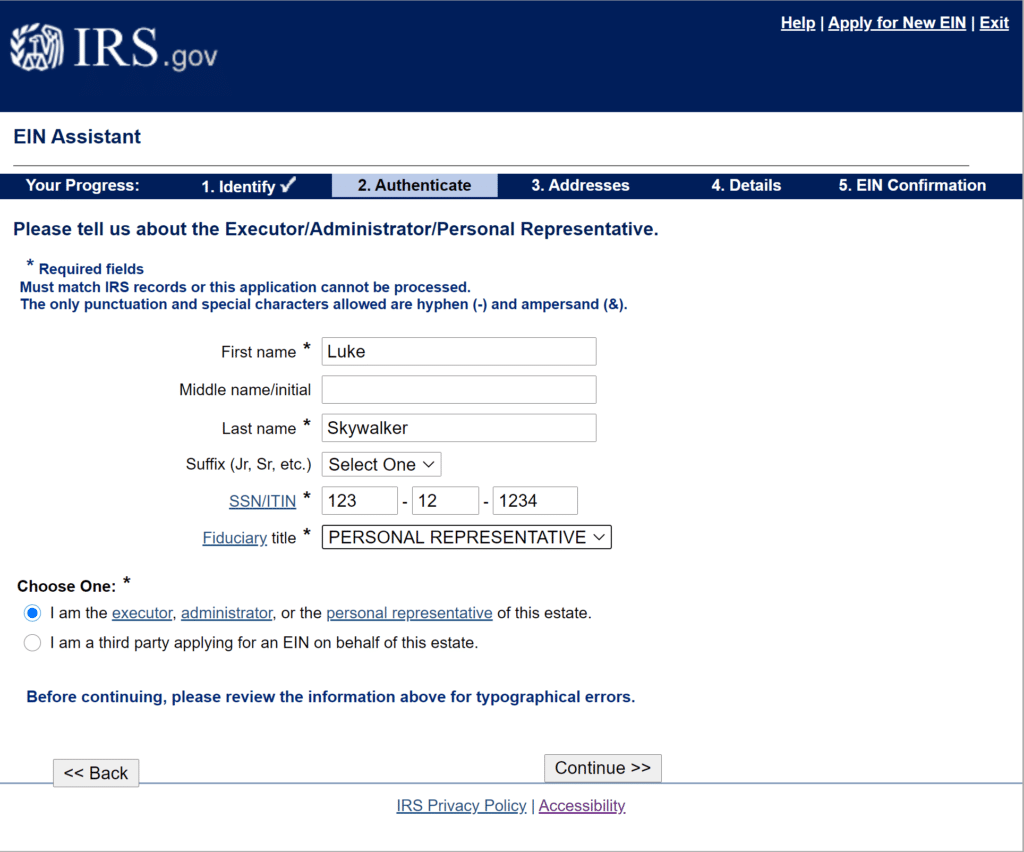

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

What Tax Returns Must Be Filed By A Florida Probate Estate

Form Dr 308 Request And Certificate For Waiver And Release Of Florida Estate Tax Lien R 10 09